What is a break-even?#

In business, break-even is the point where your total revenues equal your total costs.

At this point:

- You are not making a profit, but you are also not losing money.

- It shows the minimum amount of sales you must achieve to cover all your expenses.

break-even

Explanation:

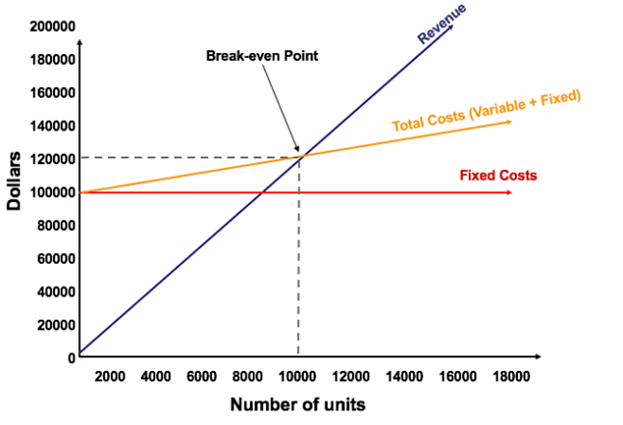

- The number of units is on the X-axis (horizontal) and the dollar amount is on the Y-axis (vertical).

- The red line represents the total fixed costs of $100,000.

- The blue line represents revenue per unit sold. For example, selling 10,000 units would generate 10,000 x $12 = $120,000 in revenue.

- The yellow line represents total costs (fixed and variable costs). For example, if the company sells 0 units, then the company would incur $0 in variable costs but $100,000 in fixed costs for total costs of $100,000. If the company sells 10,000 units, the company would incur 10,000 x $2 = $20,000 in variable costs and $100,000 in fixed costs for total costs of $120,000.

- The break even point is at 10,000 units. At this point, revenue would be 10,000 x $12 = $120,000 and costs would be 10,000 x 2 = $20,000 in variable costs and $100,000 in fixed costs.

- When the number of units exceeds 10,000, the company would be making a profit on the units sold. Note that the blue revenue line is greater than the yellow total costs line after 10,000 units are produced. Likewise, if the number of units is below 10,000, the company would be incurring a loss. From 0-9,999 units, the total costs line is above the revenue line.

Key concepts:

- Fixed Costs (FC)

Costs that do not change with sales volume (e.g., rent, salaries, insurance). - Variable Costs (VC)

Costs that vary with sales volume (e.g., materials, packaging, transaction fees). - Sales Revenue (SR)

Money earned from selling products or services.

Break-Even Formula

Break-even point (units)= | Fixed Costs _____________________________________ Selling Price per Unit – Variable Cost per Unit |

Break-even point (units) = | Fixed Costs ______________________________________ Contribution Margin Ratio |

Where:

- Contribution Margin per Unit = Selling Price – Variable Cost per Unit

- Contribution Margin Ratio = Contribution Margin ÷ Selling Price

✅ Example:

- Fixed costs = €10,000

- Selling price = €50 per unit

- Variable cost = €30 per unit

Contribution margin = €50 – €30 = €20

Break-even = €10,000 ÷ €20 = 500 units

So, you must sell 500 units to cover all costs. Every unit sold beyond that generates profit.

Break-Even Analysis Example

Colin is the managerial accountant in charge of Company A, which sells water bottles. He previously determined that the fixed costs of Company A consist of property taxes, a lease, and executive salaries, which add up to $100,000. The variable cost associated with producing one water bottle is $2 per unit. The water bottle is sold at a premium price of $12. To determine the break-even point of Company A’s premium water bottle:

Break Even Quantity = $100,000 / ($12 – $2) = 10,000

Therefore, given the fixed costs, variable costs, and selling price of the water bottles, Company A would need to sell 10,000 units of water bottles to break even

Break-even in GearLAB#

Break-even is a straightforward and simple indicator that helps make decisions based on facts, such as targeting. To ensure precise and versatile use of this value, the GearLAB system is designed to calculate the Break-even point at the smallest level—for each ad or product—broken down and updated daily.

level | meaning |

|---|---|

By Ad | A product can be promoted through hundreds of ads. But is a specific ad profitable? GearLAB evaluates each ad's contribution to the overall performance of the product. |

By Product | By collecting all data of individual ads, GearLAB provides the break-even of each product. |

By Business | A business sometimes sells several thousand products. This represents the break-even point of the global business. |

Fixed charges

It depends on the business, and it must be specified precisely in the GearLAB systems

Fixed charges (sometimes also called fixed costs) in business are the expenses a company must pay regardless of how much it produces or sells. They stay constant within a certain range of activity, unlike variable costs which change with sales or production volume.

Common examples of fixed charges:

- Rent or lease payments (office, warehouse, retail space, equipment leases)

- Salaries of permanent staff or management (not hourly wages tied to output)

- Insurance premiums (business liability, property insurance, etc.)

- Depreciation of assets (equipment, vehicles, buildings)

- Property taxes

- Utilities with a fixed component (basic charges for electricity, water, internet, phone lines, etc.)

- Loan interest payments

Why it matters:

- Fixed charges must be paid whether the business makes zero sales or millions.

- They directly influence a company’s break-even point (the level of sales needed to cover all costs).

- A business with high fixed charges has higher financial risk, because it needs steady revenue to cover them.